Form W-8BEN-E – Who is Ben?

We are sorry to disappoint you. Ben is not an attractive individual working at the Internal Revenue Service (“IRS”). “BEN” stands for “Beneficial Owner” and the “E” for “Entities”. The form is used by certain foreign entities as a certificate of status of beneficial owner for United States tax withholding and reporting.

We are sorry to disappoint you. Ben is not an attractive individual working at the Internal Revenue Service (“IRS”). “BEN” stands for “Beneficial Owner” and the “E” for “Entities”. The form is used by certain foreign entities as a certificate of status of beneficial owner for United States tax withholding and reporting.

As confusing as its name, so confusing is its guidance. Therefore, today we would like to pick out one tricky aspect of filling out

W-8BEN-E

.

Our first blog post is dealing with (drum roll): the Global Intermediary Identification Number, or in short: GIIN.

The Challenge

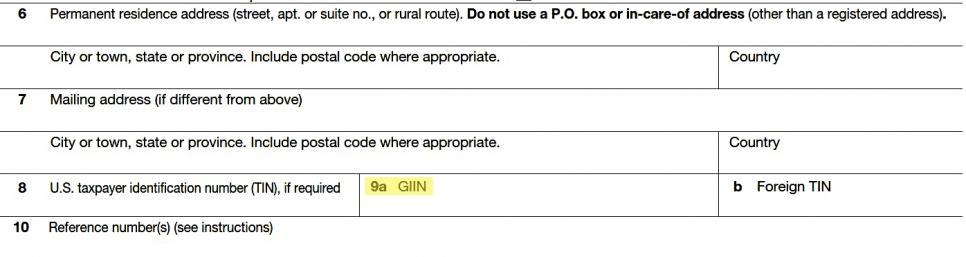

Triggered by the new W-8BEN-E form in 2017, there is a lot of confusion around when to fill Part I line 9a, when to leave it empty and when to provide the sponsor`s GIIN.

In General

Before we dive into the depths of the GIIN, we would like to briefly explain some basics.

Based on the instructions for form W-8BEN-E dated July 2017 , “the term GIIN means a global intermediary identification number. A GIIN is the identification number assigned to an entity that has registered with the IRS for chapter 4 purposes”. To simplify it, although this 19-character identification number is just a small part of the W-8BEN-E, it’s a cornerstone in identifying the entity itself to withholding agents and tax administrations for FATCA reporting . If you want to learn how the GIIN can be decoded, please have a look at the IRS page .

When do we need our own GIIN?

With some exceptions, a Foreign Financial Institution (“FFI”) is either registered with the IRS and receives its own GIIN or is sponsored by another entity.

Based on the instructions, the following classifications are required to enter their own GIIN on Part I line 9a:

- Participating FFI

- Registered deemed-compliant FFI (including a sponsored FFI described in the Treasury Regulations)

- Reporting Model 1 FFI

- Reporting Model 2 FFI

- Direct reporting NFFE

- Sponsored direct reporting NFFE

- Trustee of a trustee-documented trust that is a foreign person providing the form for the trust

- Nonreporting IGA FFI that is treated as registered deemed-compliant under Annex II to an applicable Model 2 IGA or a registered deemed-compliant FFI under regulations section 1.147-5(f)(1).

Fortunately, there is no longer the misbelief that all sponsored FFIs have to register with the IRS for obtaining their own GIIN. Unfortunately, since January 1, 2017, the question arose regarding when to put the sponsor’s GIIN on Part I line 9a and when to leave it empty, as until January 1, 2017 all sponsored entities were able to put their sponsor’s GIIN.

Which GIIN to be provided on Part I line 9a if the entity does not have their own GIIN?

Let us deal with the easy part first: no sponsor’s GIIN on Part I line 9a is required if the entity has its own GIIN, the instructions are very clear on that.

Take a breath and let’s go further to the tricky part.

Assume we have a Nonreporting IGA FFI, Sponsored Investment Entity (covered by a Model 1 IGA and without U.S. reportable account). Such an FFI does not have an own GIIN and until January 1, 2017, provided the sponsor’s GIIN on Part I line 9a. We are of the opinion that it is correct to leave part I line 9a empty in such cases for the following reasons:

- Reading the instructions, they say “(…) Nonreporting IGA FFI that are sponsored entities should provide their own GIIN (if required) and should not provide the GIIN of the sponsoring entity”.

- Further, the updated information for form W-8BEN-E (revision Date April 2016) supported our view already in 2016 as it was written: “(…) a Nonreporting IGA FFI that is a sponsored investment entity (…) is no longer required to provide the GIIN of its sponsoring entity”.

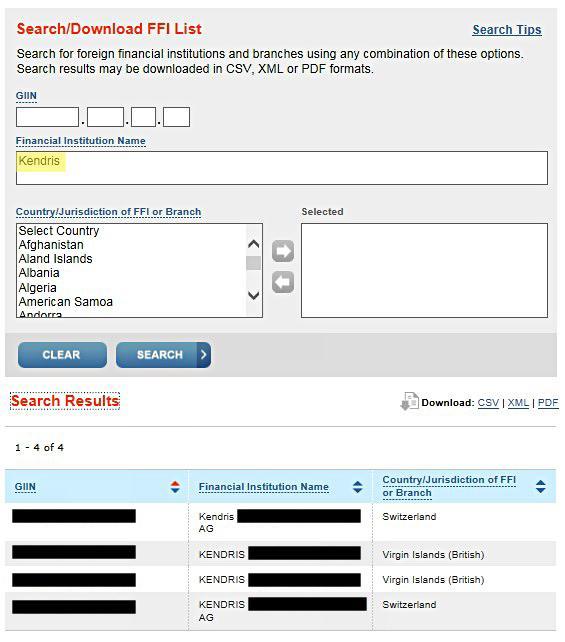

- If we provide the Sponsor’s name on the form W-8BEN-E (which is a required field), the addressee of the form can easily find the sponsor’s GIIN on the FATCA Lookup Search page with the name of the sponsor only. Checking the sponsor’s GIIN is in any case part of the due diligence the addressee should follow.

Further, a certified deemed-compliant sponsored, closely held investment vehicle also does not have an own GIIN. However, in this case we are of the opinion that providing the sponsor’s GIIN on Part I line 9a is essential for the following reason:

- Based on the Treasury Regulations (e.g. §1.1471-3(d)(5)(ii)): “(…) a withholding agent may treat a payee as sponsored closely held investment vehicle (…) if the withholding agent can reliably associate the payment with a withholding certificate that identifies the payee as sponsored, closely held investment vehicle and includes the sponsoring entity’s GIIN (…).”

From our extensive knowledge and experience dealing with this, you can feel confident knowing that you don’t need to fill in the sponsoring entity GIIN on Part I line 9a. However, we know there is still a lot of confusion surrounding this, and have found that some banks still insist that it is provided.

Due to this, we have found that if the bank insists on filling it in, then you should do it, and you should fill in W-8BEN-E as the bank accepts it. Keep in mind that the form should not be sent to the IRS but to the respective withholding agent. Therefore, if the withholding agent only accepts the form with the sponsor’s GIIN on Part I line 9a, although there is not any need for it, there does not need to be any adverse consequences if you do provide one.

Next, learn about providing a FTIN in our second W-8BEN-E help guide .

If you would like assistance with filling out the W-8BEN-E form, then please get in touch with one of our CRS and FATCA experts , or contact us at