Switzerland reported on over 3,4 million financial accounts under the automatic exchange of information in 2022

According to a press release from 10 October 2022, the Swiss Federal Tax Administration (FTA) has in 2022 exchanged information on financial accounts with 101 countries under the Common Reporting Standard (CRS) automatic exchange of information (AEoI) framework.

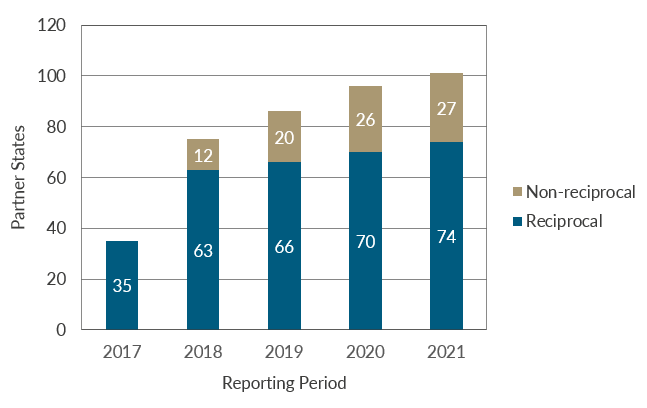

Since the first year of exchange (2018), the number of countries with which the FTA exchanges information has almost tripled. The amount of reporting financial institutions registered with the FTA and the amount of reportable financial accounts is increasing year by year. Currently, around 9'000 reporting financial institutions (banks, trusts, insurers, etc.) are registered with the FTA. These institutions are collecting data on financial accounts held and submit it to the FTA on an annual basis.

In 2022, the FTA exchanged information with 101 countries under CRS. From 27 out of these 101 countries, Switzerland received data but did not provide data in return – either because the respective countries did not (yet) meet the international requirements on confidentiality and data security, or they are so called "non-reciprocal jurisdictions" that has chosen not to receive data (temporary or permanently). Also, notably, the FTA has due to ongoing sanctions not provided any data to Russia in 2022.

The FTA has in 2022 sent information on over 3,4 million financial accounts to its partner states and received information on around 2,9 million financial accounts in return. The information that the FTA receives allows the cantonal tax authorities to verify whether Swiss taxpayers have correctly declared their financial accounts abroad in their tax return.

The following countries were added to the list of partner states since last year: Albania, Brunei, Darussalam, Nigeria, Peru und Turkey.

The chart below illustrates the development of the number of countries with which the FTA has exchanged information over the last five years.

Information about the current stand of exchange agreements with partnership states, as well as any reservations, can be found on the website of the Swiss State Secretariat for International Finance (SIF).

If you have any questions or need CRS advice or reporting services, please do not hesitate to reach out to our CRS experts. The services we provide include advice on matters such as classification, due diligence and reporting, as well as reporting services – helping you to stay on top of your obligations.