Increase in Swiss Value-added tax (VAT) – changes as of 1 January 2024

Last year, the Swiss electorate said “Yes” to the proposed “OASI / AHV 21” reform and thus also agreed to the increase in the Swiss VAT rates.

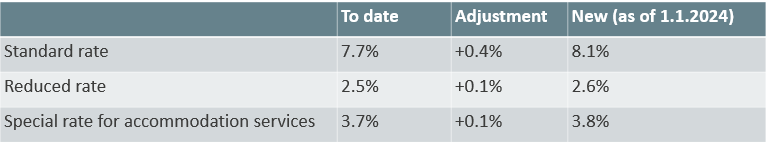

The Old Age and Survivors Insurance (OASI / AHV 21) reform was adopted by the general population and the establishment, thus ensuring the financial support of the AHV until 2030. Amendments to the AHV Act and the Federal decision on additional financing of the AHV by increasing VAT were also approved. To compensate for the expected deficit of the AHV, as of 1/01/2024, the VAT rates in Switzerland will be raised as follows:

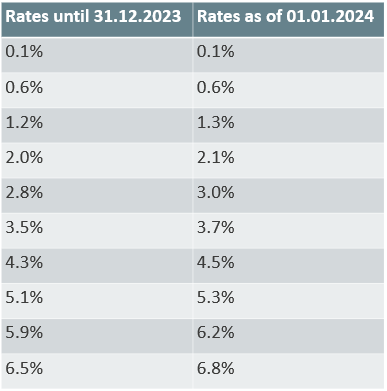

The adjustment of the VAT rates is accompanied by an update to the regulation on the net tax rates (Saldosteuersätze) according to sector and business activity. As of 1/01/2024, the following revised net tax rates and flat-rate tax rates also apply:

What time is relevant for determining the tax rate?

The VAT liability is still incurred irrespective of the applicable tax rate at the time of invoicing or receipt of payment (depending on the billing method selected).

In any case, the time or period when the services are rendered and not the date of invoicing or receipt of payment is decisive for determining the applicable tax rate. For the purposes of the tax rate increase, the time at which the service is provided is of decisive importance; it determines whether the taxpayers can invoice their services at the previous (lower) VAT rate or already must apply the new (higher) tax rate.

Essentially, services provided prior to 1 January 2024 are taxable under the previous tax rates, while services provided after 31 December 2023 are subject to the new higher tax rates.

What must be observed for services provided across different accounting periods?

If services are provided beyond the end of the year (such as subscription, maintenance or leasing contracts), the service fee must be divided according to the period before and after 1 January 2024 and settled “pro rata temporis” with the current and the new tax rates. For orders that are not yet completed on 31 December 2023, it is advisable to issue partial invoices for services that have already started. In the case of construction work, for example, the time of performance is defined as the date on which the work is actually carried out on the building.

Settlement with the Swiss Federal Tax Administration (ESTV):

For the 3rd quarter of 2023 (using the effective method) or the second semester of 2023 (using the net tax rate), companies will for the first time have the option to account for sales to the FTA using both the previous and the new tax rates. Fees that are to be recorded in a previous statement but relate to services that are provided after 1 January 2024 must, for the time being, still be declared at the previous tax rates. At the earliest, correction is possible in the above-mentioned statements and must be made at the latest with the conclusion of the 2023 tax period.

Detailed information was published in February of this year in MWST-Info 19 (VAT Info 19) under the title “Tax rate increase as of 1 January 2024”.

Conclusion, or what impact does this have on your company?

For each service provided at a time or during a period (performance of the service) that falls after 31 December 2023, special attention must be paid to correct taxation of the turnover. Taxpayers should already categorise their services now and check when the first settlements must be made with the new tax rate.

The necessary adjustments in the ERP systems often prove to be more complex and time-consuming than assumed. It is therefore advisable to prepare an action plan in advance to ensure that the systems are converted to the new VAT rates in a timely manner and that invoicing is correct.

Determine a specific “GO LIVE” date for your business, i.e. a time by which systems must be adapted, invoice templates updated, old and new tax rates taken into account, contractual bases reviewed and adapted if necessary, price lists adjusted, accrual issues clarified and employees trained.

We would be pleased to guide you through the implementation process and remain at your disposal for a non-binding meeting.