The Private Trust Company – or PTC – explained

The Private Trust Company (PTC) is a powerful tool to structure family wealth, streamline governance and optimise succession planning strategies. How does a PTC structure work, how can it benefit a family, and why is Switzerland an attractive place to establish it?

What is a Private Trust Company (PTC)?

A Private Trust Company is a company that acts as trustee of one or more trusts established for the benefit of one or several connected persons, usually a family. As the name suggests, a PTC is a private company and does not offer trustee services to the general public. PTCs are commonly established by high-net-worth families owning substantial family businesses and other complex assets, such as real estates, yachts, airplanes, artworks, etc.

A Private Trust Company structure provides a succession planning framework that enables wealth owners to transfer their assets in a structured way to the next generation. With a PTC, high-net-worth families can structure their wealth in a way to keep control even in situations of a family conflict, divorce, or the death of a family member. Using a PTC as private trustee also allows family members to be included in the decision-making processes. Family members can either sit on the board of the PTC, or they can be part of advisory committees. A PTC is therefore not only a vehicle for a family to ensure bespoke trustee services, but it can also serve as a family governance tool.

In practice, PTCs are often administered by professional trustees to ensure compliance with legal and regulatory requirements applicable in the respective jurisdiction in which the PTC is incorporated. Besides Switzerland, other popular jurisdictions to establish a Private Trust Company are the Channel Islands (Guernsey, Jersey, Isle of Man), The Caribbean (British Virgin Islands, Cayman Islands, etc.), as well as Singapore and the United Arab Emirates.

Private Trust Companies in Switzerland

In case of a Swiss PTC, a professional Swiss trustee will for example ensure that the PTC is compliant with Swiss Anti-Money Laundering laws, international automatic exchange of information requirements, international mandatory disclosure rules / DAC 6, Swiss and international economic substance requirements, or the recent Financial Institutions Act (under which PTCs are exempt under certain conditions from licensing requirements). A professional trustee also ensures that the administration of the trust for which the PTC acts as trustee is carried out with the required skill and care, and that the fiduciary powers are exercised in accordance with the trust instrument and the governing law of the trust.

Last but not least, a professional trustee will verify that the PTC’s corporate and tax matters are professionally taken care of.

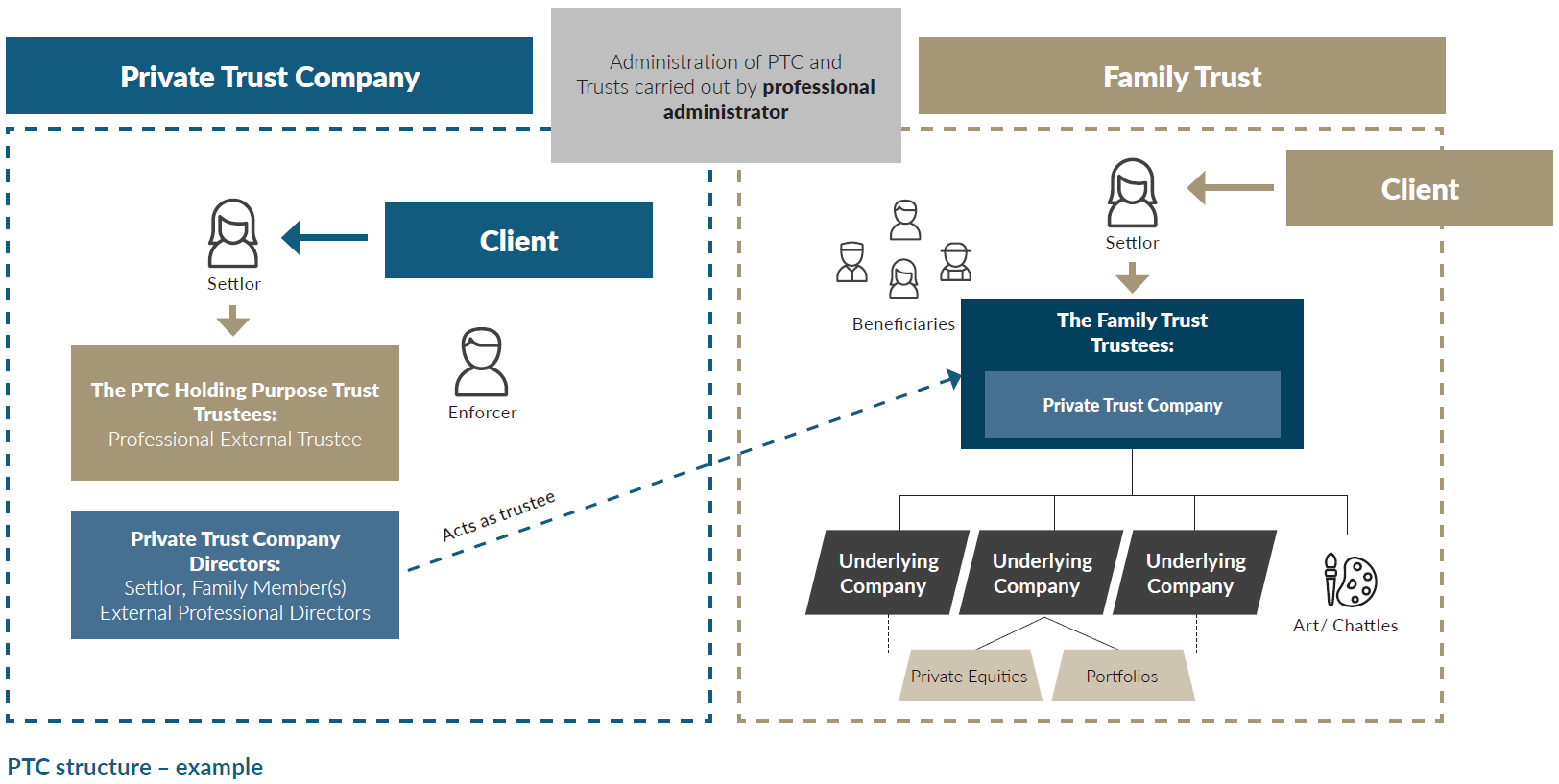

Example of a typical Private Trust Company structure

Like any other company, the Private Trust Company is run by its board of directors.

The composition of the board typically consists of:

- Professional trust company officers;

- family members; and

- trusted family advisors.

The shares of a PTC are usually owned by a dedicated Purpose Trust managed by a professional trustee. Direct ownership by family members is possible, but in practice rarely the optimal solution as the succession planning and confidentiality aspects are with an individual ownership not properly taken care of. A typical PTC setup is often structured as follows:

The PTC can act for different trusts, as long as all trusts are established for a closed group of connected persons, usually a family spanning various branches and generations.

Why establish a Private Trust Company in Switzerland?

Switzerland is a reputable and political stable world leading trustee and trust administration jurisdiction. Paired with a high degree of technical and cross-border competence, embedded in an international financial center, Swiss professional trustees adhere to the highest standards of care and professionalism required to support clients and their families in the administration of a PTC and family trusts.

What are the benefits of a Private Trust Company structure?

Family Governance

A PTC allows a client, family members and trusted advisors to participate in the decision-making and management of the PTC, without compromising the legal validity of the family trusts. This is especially valuable in complex family situations where heightened knowledge of the family’s business, financial affairs and the family members’ individual needs is required for the trustee to take appropriate decisions. A PTC can also provide the legal infrastructure for a family office.

Family Control

A PTC allows clients and their family members to retain more control over their trusts compared to relying on a corporate trustee to act on their behalf. Clients can select individuals to serve in various roles in the PTC setup, for example in the board of directors of the PTC, in the PTC trustee advisory committee or in the investment and distribution committees of the family trusts.

Continuity of Trustee

Changing a trustee can be a long and arduous process, and changing the ownership of the trust property, especially if registered in public registers, can be cumbersome. A PTC offers the advantage that only the board of directors of the PTC needs to be replaced in case of a change of the service provider. This ensures continuity in the trusteeship of the family trusts and ultimately in the ownership of the trust assets.

Flexibility

Increased regulatory pressure has led to the implementation of strict policies and procedures for professional trustees. Taking trustee decisions is therefore often a lengthy process that involves legal and compliance departments. Within a PTC, decisions are processed faster, with less overhead and less people involved in their execution.

What are potential disadvantages of a Private Trust Company structure?

Before deciding to establish a Private Trust Company, it is essential to consider some potential challenges:

- Initial costs: Setting up a PTC involves certain initial expenses.

- Ongoing costs of maintaining a PTC: While a Private Trust Company offers the advantage of continuity, it also incurs long-term maintenance costs.

- Wealth threshold: Typically, a PTC is most suitable for a net worth exceeding $50 million.

- Family involvement: The involvement of family members in the decision-making comes with the risk of potential conflicts.

- Regulatory compliance: Selecting the right professional trustee is crucial to effectively manage all regulatory requirements and obligations.

How to incorporate a Private Trust Company in Switzerland

PTCs should be established and managed by professional service providers who can assist with:

- the establishment of the complete PTC structure

- the domiciliation and corporate administration of the PTC, including tax filings and accounting services

- support with AML duties of the PTC, including acting as AML officer, if required

and provide management and administration capabilities such as:

- act as trustees, directors, protectors or enforcers within the PTC structure

- support with regulatory reporting duties (CRS/FATCA/DAC 6) and compliance with economic substance requirements in various jurisdictions

- statutory accounting for all or selected entities within the PTC structure

- consolidated financial reporting and performance monitoring for all the assets held in the PTC structure

The essence of the Private Trust Company (PTC) framework

A Private Trust Company provides a structured framework for high-net-worth families to ensure continuity and control over their family assets, including family businesses.

With a PTC, families can mitigate the risk of fragmentation or loss of control over their assets due to conflicts, divorce, or death of family members. The choice of jurisdiction is crucial when establishing a PTC. For many high-net-worth families, Switzerland is a preferred and reputable destination for their Private Trust Companies, known for its political and economic stable environment.

In case you would like to know more about the Swiss Private Trust Company possibilities, or learn about different alternatives depending on your situation, do not hesitate to contact us.